The PM Shram Yogi Mandhan Yojana is a visionary pension scheme introduced by the Government of India to support unorganised sector workers. Designed to provide financial stability during retirement, the scheme offers a guaranteed monthly pension of ₹3,000 upon reaching the age of 60. With minimal monthly contributions starting as low as ₹55, workers in informal sectors can secure a stable future for themselves. The scheme ensures joint contribution by both the worker and the government, making it an inclusive and sustainable initiative.

Targeting workers with a monthly income of up to ₹15,000, this scheme addresses the long-standing issue of financial vulnerability among labourers, domestic workers, construction workers, and others in unorganised sectors. By enrolling in the PM Shram Yogi Mandhan Yojana, eligible individuals can not only secure their retirement but also gain access to a government-supported financial safety net that empowers them to live with dignity.

PM Shram Yogi Mandhan Yojana: Overview

| Aspect | Details |

|---|---|

| Scheme Name | PM Shram Yogi Mandhan Yojana |

| Launched By | Government of India, Ministry of Labour & Employment |

| Target Beneficiaries | Unorganized sector workers earning ₹15,000 or less |

| Benefits | ₹3,000/month pension after the age of 60 |

| Eligibility | Workers aged 18-40, monthly income ≤ ₹15,000 |

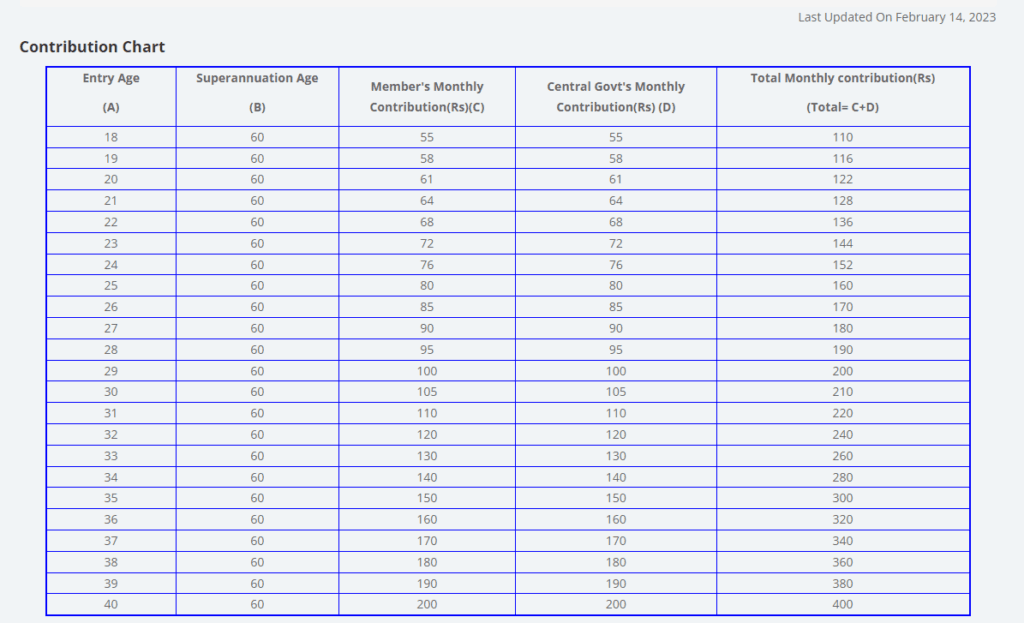

| Contribution | ₹55 to ₹200/month based on entry age |

| Mode of Application | Online through maandhan.in |

| Required Documents | Aadhaar card, PAN card, Bank account details, E-Shram card |

| Government Contribution | Equal to the worker’s contribution |

What is PM Shram Yogi Mandhan Yojana?

The PM Shram Yogi Mandhan Yojana is a voluntary and contributory pension scheme for workers in the unorganized sector who earn ₹15,000 or less per month. The scheme requires workers to make monthly contributions, which are matched by the government. Upon reaching 60 years of age, they are eligible to receive a fixed pension of ₹3,000 per month.

This initiative is designed to offer financial independence to workers who often lack access to other retirement benefits such as EPF (Employees’ Provident Fund) or ESIC (Employees’ State Insurance Corporation).

Contribution Chart Structure

The contribution varies based on the worker’s age at the time of enrollment. Here’s a breakdown:

Key Features of PM Shram Yogi Mandhan Yojana

- Guaranteed Pension: Eligible beneficiaries will receive a pension of ₹3,000 per month after turning 60.

- Voluntary Scheme: Workers can opt to join the scheme at their discretion.

- Government Contribution: The government matches the worker’s contribution, making it a joint effort to secure their future.

- Minimal Contributions: Contributions range from ₹55 to ₹200 per month, depending on the age at the time of enrollment.

- Online and Easy Enrollment: Workers can enroll through the official portal maandhan.in or Common Service Centers (CSCs).

PM Shram Yogi Mandhan Yojana Eligibility Criteria

To benefit from the PM Shram Yogi Mandhan Yojana, individuals must meet the following conditions:

- Age Requirement: The scheme is open to individuals aged 18 to 40 years.

- Income Limit: Monthly income must not exceed ₹15,000.

- Employment Type: Must be an unorganized sector worker, such as:

- Domestic workers

- Construction laborers

- Rickshaw pullers

- Agricultural laborers

- Brick kiln workers

- Required Documents:

- Aadhar Card

- Bank account details (passbook)

- PAN card

- Mobile number

- Passport-sized photograph

Note: Applicants must not be part of other government pension schemes like EPF, NPS, or ESIC. Income tax payers and organized sector employees are also excluded.

Benefits of PM Shram Yogi Mandhan Yojana

- Financial Security: A steady monthly income of ₹3,000 post-retirement.

- Affordable Contributions: Contributions are minimal and age-based.

- Support for the Unorganized Sector: Workers in informal sectors, often excluded from formal pension plans, can benefit significantly.

- Government Backing: Contributions are matched by the central government, ensuring fund growth.

- Coverage for Spouses: In case of the subscriber’s demise, the spouse is eligible to receive 50% of the pension as a family pension.

How to Apply for PM Shram Yogi Mandhan Yojana: Step-by-Step Guide

Enrolling in the PM Shram Yogi Mandhan Yojana is a straightforward process. Here is a step-by-step guide to help you apply for this beneficial pension scheme:

Step 1: Visit the Official Portal

- Go to the official PM Shram Yogi Mandhan Yojana website: maandhan.in.

Step 2: Select “New Enrolment.”

- On the homepage, navigate to the Services tab.

- Click on New Enrollment to start your application process.

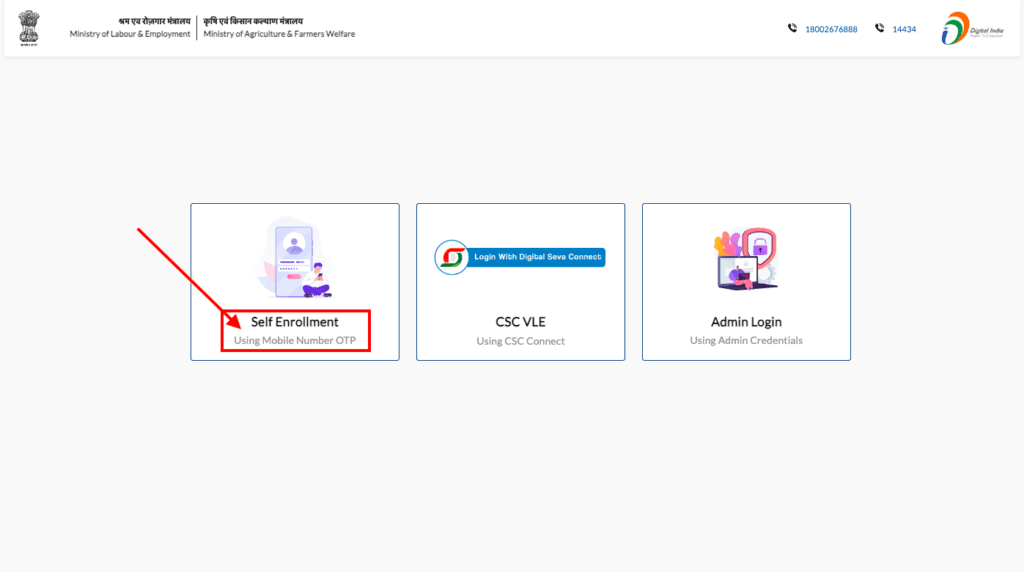

Step 3: Choose Enrollment Method

- Select Self Enrollment if you wish to apply directly online.

- Alternatively, you can visit a nearby Common Service Center (CSC) for assisted enrollment.

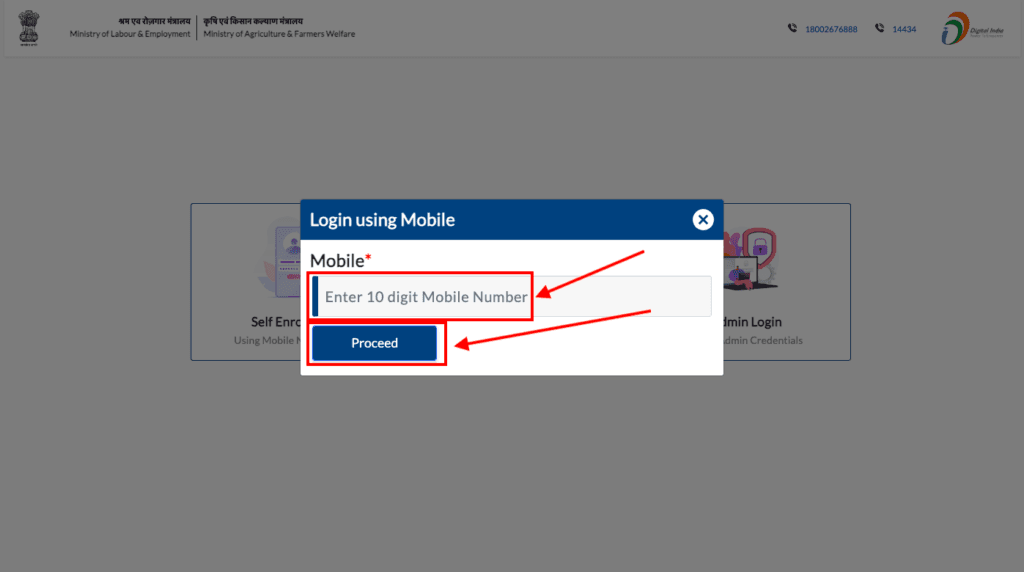

Step 4: Mobile Number Verification

- Enter your mobile number in the required field.

- Click on Proceed, and an OTP (One-Time Password) will be sent to your registered number.

- Enter the OTP and click Verify to proceed further.

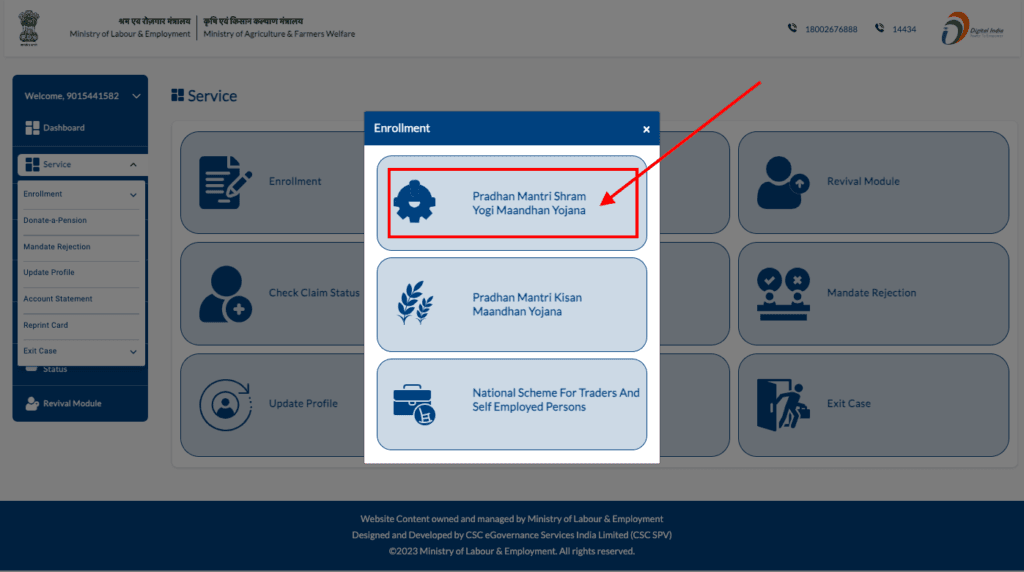

Step 5: Choose the Scheme

- After logging in, select PM Shram Yogi Mandhan Yojana from the available pension schemes.

- You will be prompted to confirm if you have an E-Shram Card.

- If yes, click Yes and proceed.

- If no, click No, and follow additional instructions to create one.

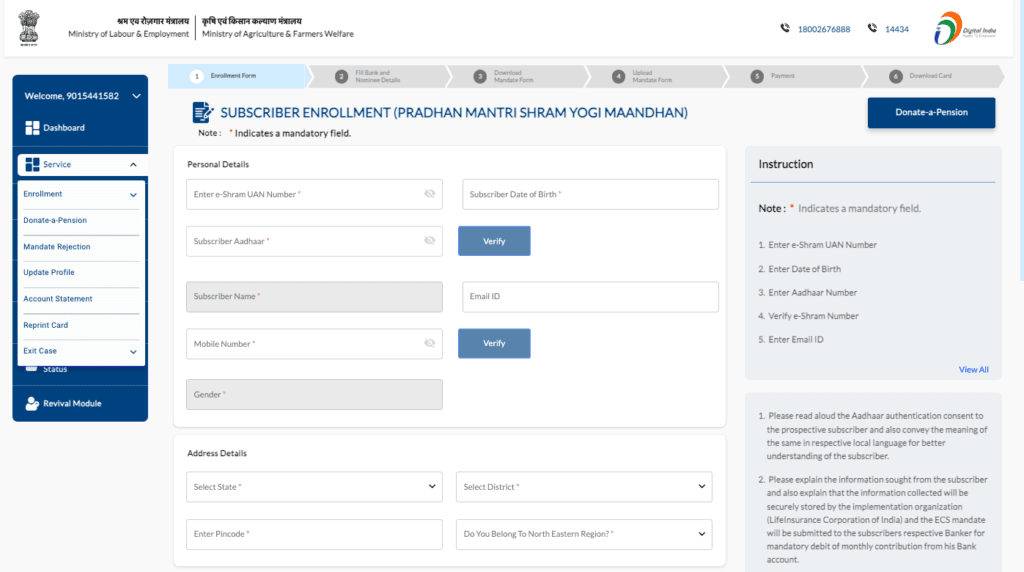

Step 6: Fill in the Application Form

- Provide your personal details, including:

- Name (as per Aadhaar)

- Date of Birth

- Aadhaar Number

- Bank Account Details (Account Number & IFSC)

- Mobile Number

- Upload required documents such as your Aadhaar card, PAN card, and a passport-sized photo.

Step 7: Contribution Details

- Based on your age, the system will display your monthly contribution amount.

- Agree to the terms and conditions, and confirm the contribution.

Step 8: Make the First Payment

- Complete the initial contribution payment online via net banking, debit card, or UPI.

- This will activate your enrollment in the scheme.

Step 9: Download Enrollment Certificate

- After successful submission and payment, download the acknowledgment or enrollment certificate for your records.

Important Points to Remember

- Ensure all the details provided are accurate to avoid rejection of your application.

- Contributions will continue to be auto-debited from your linked bank account until the age of 60.

- You can track your application and contributions online through the portal.

Who is Ineligible for PM Shram Yogi Mandhan Yojana?

Certain individuals are excluded from the scheme:

- Taxpayers or individuals earning more than ₹15,000 per month.

- Beneficiaries of other government pension schemes like NPS, EPF, or ESIC.

- Government employees and professionals like doctors, lawyers, and engineers.

Why Should You Enroll in PM Shram Yogi Mandhan Yojana?

The PM Shram Yogi Mandhan Yojana provides a sense of financial security to unorganized workers who often struggle to save for retirement. With its low contribution rates and government support, the scheme ensures that even the lowest-earning workers can have a stable income in their old age.

If you are an eligible unorganized sector worker, enrolling in this scheme could be a crucial step toward a worry-free retirement.

Conclusion

The PM Shram Yogi Mandhan Yojana stands as a beacon of hope for millions of unorganized sector workers in India. By contributing a small amount monthly, workers can secure their future and enjoy a dignified retirement. Take the first step today by visiting the official portal and applying online. Ensure your golden years are financially secure with this government-backed pension scheme.

Impotant Links

| Home Page | Click Here |

| PM Shram Yogi Mandhan Yojana Apply Link | Click Here |

| Official Website | Click Here |